The simmering geopolitical tensions between Russia and Ukraine have devolved into an all-out invasion of the Eastern European country, driving global investors into safe-haven assets like US bonds, the Japanese yen, and gold.

Did you notice any notable absences from the above safe haven list? What about the so-called “digital gold”, Bitcoin?

Unfortunately for crypto’s true believers, the nascent asset class is selling off across the board, and the total market capitalization of cryptoassets has fallen by more than $150B in the last 24 hours alone!

Why is Bitcoin falling?

While it’s not surprising to see smaller “altcoins,” which are in many cases more akin to early-stage technology startups, falling as a massive wave of risk aversion hits global markets, the accompanying selloff in Bitcoin serves as a prominent reminder that the “institutions are coming” narrative is a double-edged sword:With larger funds, corporations, and investors allocating to Bitcoin over the last year or two, correlations between the cryptocurrency and more traditional investments have surged.

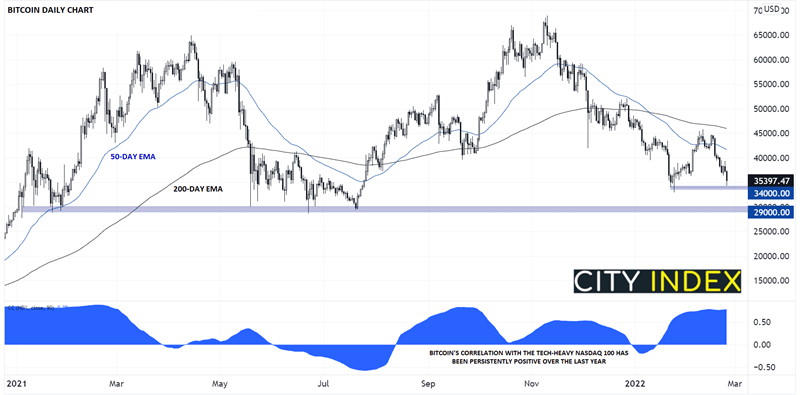

As the chart below shows, the rolling 90-day correlation between Bitcoin and the tech-focused Nasdaq 100 has turned generally positive, with the current reading of 0.78 showing a strong correlation between technology stocks and Bitcoin:

Source: TradingView, StoneX

Where next for Bitcoin?

Looking ahead, Bitcoin remains in a bearish medium-term trend off its November high, with the 50-day EMA trending lower below the downward-trending 200-day EMA. The next level of support to watch comes from January’s lows in the $34,000 level, but the strong bearish momentum and ongoing geopolitical turmoil may well be enough to blast through that level in short order. Below $34,000, the next logical target for bears would be the 2021 lows in the $29,000-30,000 zone.

Even if we do see prices bounce from one of these support levels, crypto traders are more likely to sell into strength as long as Bitcoin remains below its 200-day EMA in the 45,000 zone.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade