- Crypto investors continue to ignore rising yields, dollar

- Crypto trader eye direction from BTC’s next move

- Week’s macro data highlights include PMIs and PCE Price Index

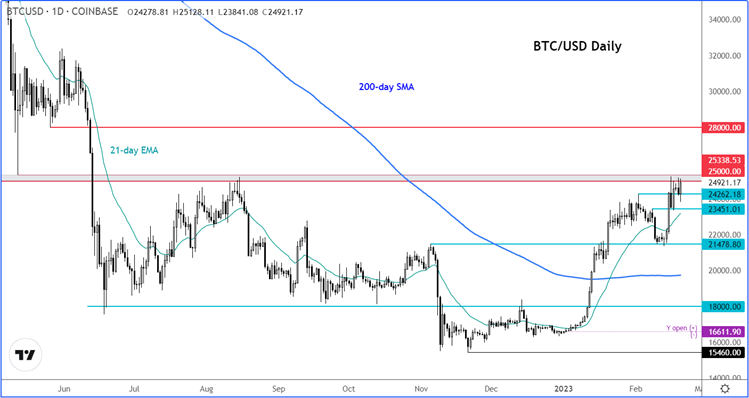

Bitcoin has been teasing the $25K level over past several days. Crypto assets have remained supported near their recent highs despite the Dollar Index finishing higher for the 3rd consecutive week and bond yields being on the ascendency. In theory, these moves should have impeded Bitcoin’s recovery since the latter doesn’t pay any interest or dividend. We have seen gold and silver struggle, while US stock markets have not been able to go much higher. Crypto investors have ignored these forces.

But if expectations of higher interest rates for longer continues, then we may well see renewed weakness creep back into the sector. For now, the bulls are continuing to exert pressure for an upside breakout.

After holding key support last week at around $21.5K, a level which was resistance back in November and preceded the BTC /USD’s last plunge, Bitcoin has rallied to $25K. Here, Bitcoin had formed its previous peak in August of last year. It is thus a significant level. A clean break above $25K would give the bulls a much-needed confidence boost that it has bottomed. If that happens, then we could see follow-up technical buying in the days to come towards the high $20Ks. In turn, other crypto prices might find support on the back of this potential breakout.

However, if the bulls show any signs of weakness, then the bears will be quick to pounce given the recent moves in the dollar and bond markets, and drive prices back down to the low $20Ks or even lower.

The US dollar’s ability to hold its recent recovery is a big factor in determining whether Bitcoin and other crypto prices will stay elevated. We have seen hotter-than-expected jobs and inflation data, and lots of hawkish comments from Fed officials as a result. Investors have boosted their expectations about the terminal interest rate in the US to well above 5%, than below it. Rising bond yields represents an opportunity cost for yield-seeking investors for holding zero-yielding assets like gold and Bitcoin.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade