The Commonwealth Bank of Australia (CBA) is Australia's largest bank and provides a variety of financial services, including retail, business, and institutional banking, funds management, insurance, investment, and broking services. It reports its Full Year numbers next Wednesday, August 10th.

For the year's first half, CBA reported a 23% increase in cash profit after tax (Cash NPAT) to $4,746 million and declared a fully franked interim dividend of $1.75 per share.

The bumper result came from strong business outcomes, including the business and home loan sectors that thrived in the low-interest rate environment. Specifically, home loans rose 8.5% to $40.4 billion, while business loans rose by 12.5% to $13.2 billion.

"Higher cash profits were a result of continued volume growth across the business in home lending, business lending and deposits lower loan impairment expense due to the improving economic outlook, and a reduction in remediation expenses.”

Switching to lower margin fixed home loans, rising swap rates due to future expectations of higher interest rates, and continued pressure from home loan competition, caused CBA’s NIM (Net Interest Margin) to fall 14 basis points to 1.92%.

In May, the RBA began tightening interest rates, and the cash rate is now 175bp higher than in April. Rising cost of living pressures and higher mortgage rates have weighed on appetite for home loans and business credit.

This has, in turn, resulted in the fastest fall in house prices in forty years, which has weighed on consumer confidence and is beginning to flow through into household spending.And this is where it gets interesting.

While higher interest rates are hurting the housing and loan markets, which in turn increases the chances of a recession and the associated bad debts, the RBAs rate hiking cycle is helping the banks to greater profitability via widening net interest margins (NIMS).

Before the RBA’s August rate hike, the big banks are believed to have passed on less than a quarter of the RBA’s rate hikes. Even a tiny 0.2% increase in NIM is expected to increase the banks bottom line by $7bn annually or $580million per month.

Outside of its traditional business, the bank is facing a $2bn hit to its investment in Swedish BNPL firm Klarna which has seen an 85% fall in its valuation due to a reversal in market sentiment and botched expansion plans.

For the record, Commsec is expecting to see the CBA announce a Full Year NPAT of $9.3 billion and a second-half dividend of $2.14 which would amount to a grossed-up dividend yield of 5.6% for FY22.

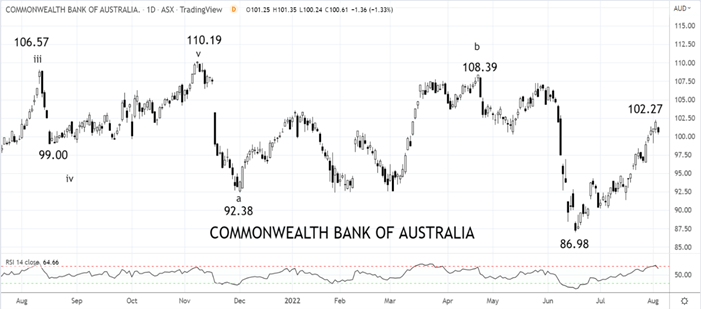

As the chart below illustrates, CBA has spent the past six weeks rallying from its Mid-June $86.98 low to a high last week at $102.27. The rally appears impulsive and suggests the correction from the November $110.19 high is complete. Dips back towards $96.50 should be well supported, looking for a retest of the 110.19 high into year-end.

Source Tradingview. The figures stated are as of August 3rd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation