Qantas Airways Limited (QAN) is the flag carrier of Australia and the third oldest airline in the world. It reports its full-year numbers on Thursday, August 25th.

Few industries were as devastated by the impact of Covid-19 as the airline industry. An outbreak of the Delta variant in Sydney in late June 2021 forced three states along the Eastern Seaboard to enter another round of lockdowns that lasted until October.

The Delta lockdowns restricted Qantas’s operations, and the airline reported an underlying loss for the half year ending 31 December (1H FY22) before tax of $1.28bn and a loss of $245 million EBITA (underlying earnings before tax, depreciation, and amortization). During this period, Qantas also managed to trim its net debt by $400m to $5.5bn.

An outbreak of the fast-spreading Omicron variant before Christmas sent many into voluntary lockdown and caused a new round of travel disruptions during the early months of the 2H of FY22.

Since that point, the restart in the travel industry has gone from strength to strength. However, with the unleashing of stored pent-up demand for travel came new challenges.

A tight labour market and Covid-related impact meant the travel industry has faced a “challenging restart for the industry globally”. Qantas’s proud reputation has been tarnished by a storm of cancellations, lost luggage, call-centre delays, layoffs, and outsourced jobs, all of which have created national outcry.

Since April, Qantas and Jetstar have recruited over 1,000 operational team members and hundreds of additional contact centre staff to help slash average call wait times. Qantas has added 20 per cent more team members on standby to minimise any impact of sick leave.

Qantas has also made schedule adjustments to spread peak times better and made two widebody aircraft available to assist if required. The airline has rolled out new check-in and baggage kiosks to speed up customers’ journeys.

In a trading update in June, the company noted that solid demand across domestic and international travel has resulted in net debt levels falling to around $4bn, an improvement of $1.5b in just six months.

While the Group still forecasts a significant full-year Underlying EBIT loss for FY22 that includes the worst of the Delta and Omicron impacts and restart costs, the business remains on track for 2H22 Underlying EBITDA of between $450 million to $550 million. The Group is also on its way to returning to Underlying profit in FY23.

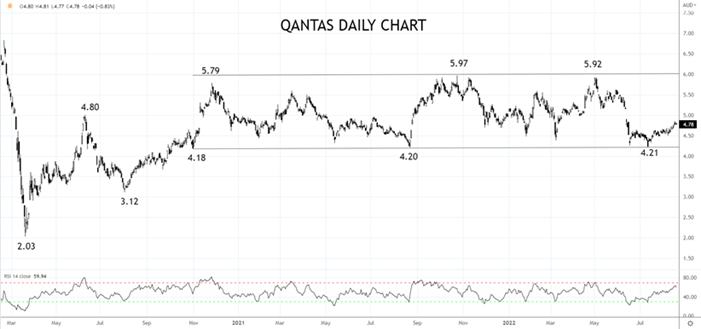

QANTAS Share Price Chart

After falling from a high of $7.46 pre-COVID to a low of $2.03 in March 2020, the share price of Qantas has spent the past 21 months trading in a range between $4.20 on the downside and $6.00 on the topside.

The sideways price action lends itself to being long Qantas shares in the $4.80/60 range with a sell stop on a daily close below $4.10. The target for the trade would be the top of the range at $5.90/$6.00 area, providing a neat 2:1 risk-reward profile.

Source Tradingview. The figures stated are as of August 18, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade