After the RBA Minutes noted yesterday that members had considered a 40bp rate increase at the May meeting, the focus for traders this morning was firmly on Q1 AU 2022 wages data - seeking clues as to the size of the RBA's next rate hike.

If there was ever a time for wages growth to reflect the underlying strength within the broader labour market, today was the day - particularly after the RBA noted in yesterday's minutes

"More timely evidence from liaison and business surveys indicated that labour costs were rising in a tight labour market and a further pick-up was likely over the period ahead."

Today's data showed that in Q1 22, the annual pace nudged up to 2.4%, well above the 1.4% low of 2020 but still well below the 3% level the RBA expects to see by the end year and significantly below the inflation rate of 5.1%. Real wages - adjusted by headline inflation - are down 2.6% over the past year.

In response, the interest market promptly dialed back its expectations of a 40bp rate hike next month and the market is now evenly split between a 25bp and 40bp hike.

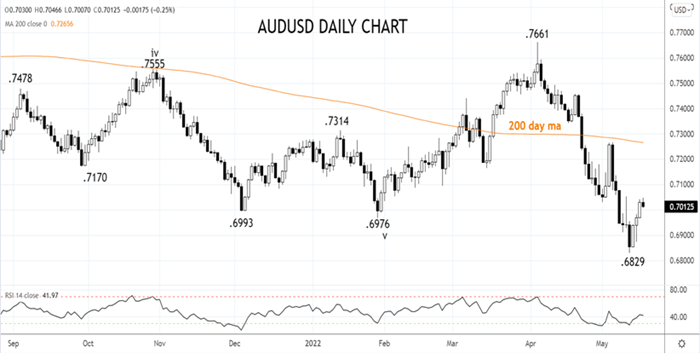

Combined with the possibility of a smaller hike than expected in June and this morning's news of fresh Covid-19 outbreaks around key Chinese cities, which raises the possibility of another round of damaging lockdowns, the AUDUSD has eased from its morning high of .7047 to be back trading around .7000c at the time of writing.

As we noted yesterday here providing the AUDUSD does not see a sustained break and close above resistance at .7100/20c, the risks remain for another leg low towards support near .6600c.

Source Tradingview. The figures stated are as of May 18, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade