Market summary

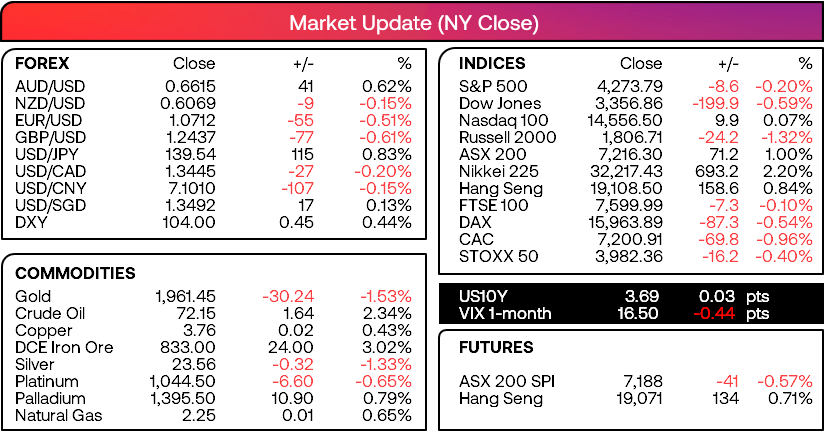

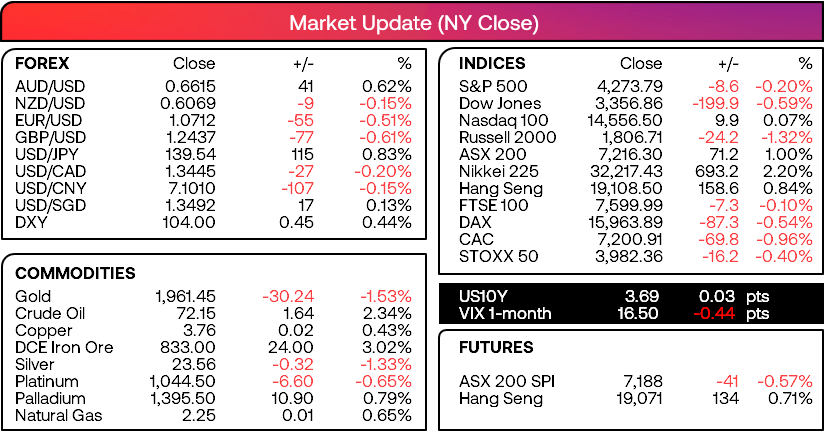

- The ISM services report fanned concerns of a recession with a mild expansion of 50.3 (below 50 denotes industry contraction)

- Prices paid (a gauge of industry inflation) expanded but at its slowest pace in three years

- New orders also expanded at a slower pace of 52.9 (and beneath its 1 and 3-month averages)

- Apple shares closed lower after unveiling a US $3500 VR headset, printing a potential key reversal on high volume after briefly touching a record high

- ECB President Christine Lagarde acknowledged “signs of moderation” for the eurozone’s core CPI but conceded it was too soon to call peak inflation

- Oil retracted lower to fully close the weekend gap, which originally saw WTI rise $3 on news that Saudi Arabia were to cut oil production by 10% from July

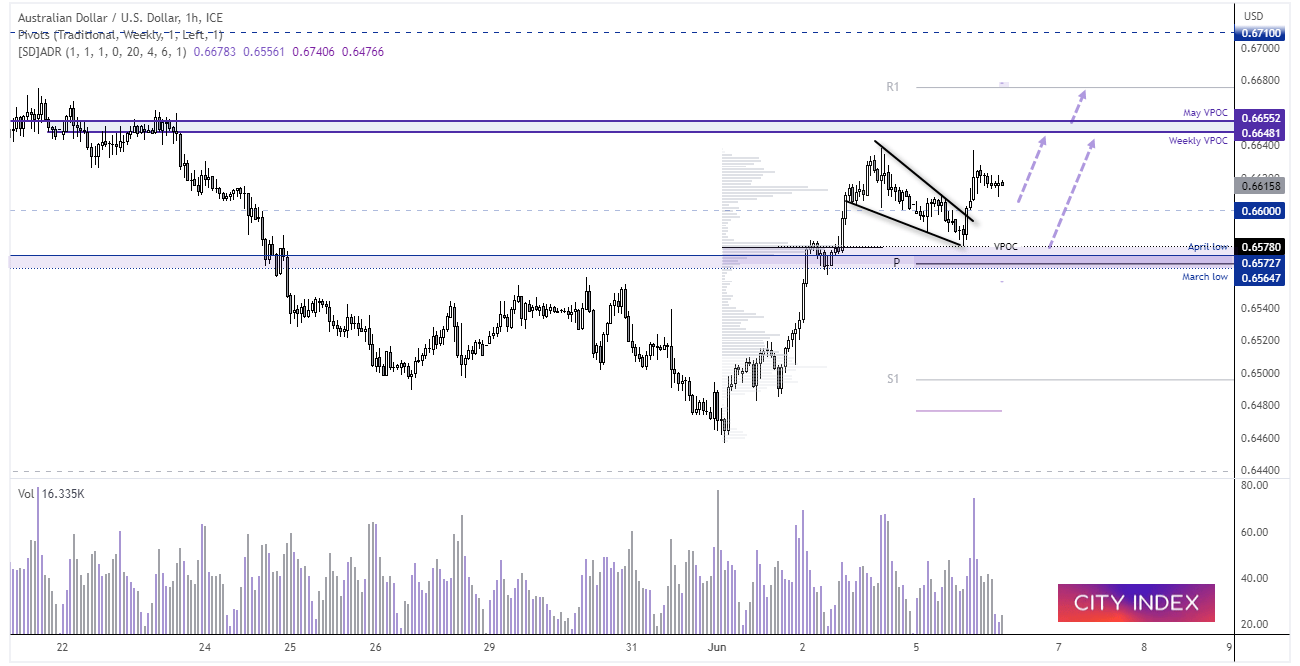

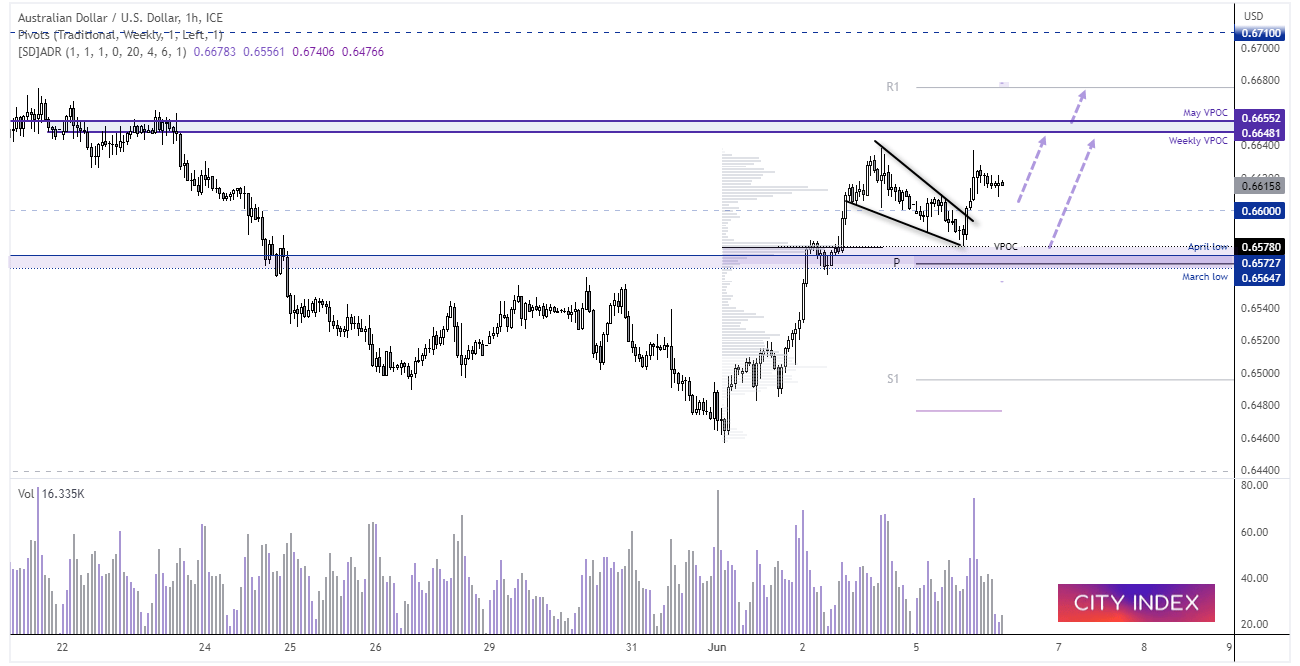

- AUD/USD pulled back to the lower support zone before ahead of today’s RBA meeting before rallying on a weaker US dollar, where today’s decision remains ‘finely balanced’ as to whether the RBA could pause or hike

- China’s services PMI expanded faster than expected according to the private survey by Caixin, helping to lift sentiment in the Asian session

- GBP weakest, CHF and JPY strongest

- Read our weekly COT report for market positioning of forex, commodities and stock market indices traders

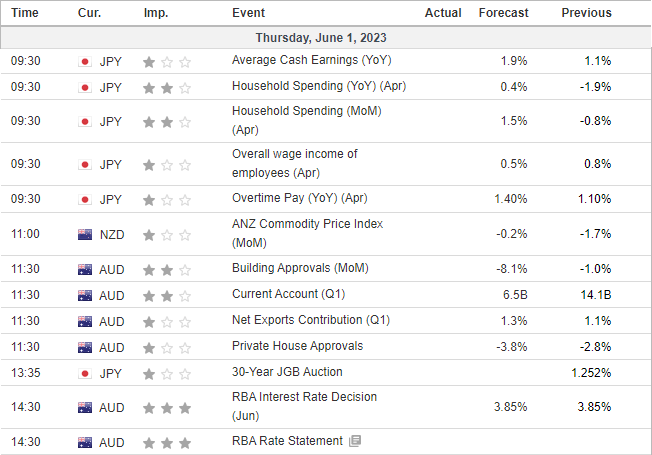

Events in focus (AEDT):

- 09:30 – Japan household spending, overtime pay

- 11:30 – Australia balance of payments, household spending, building approvals (updated)

- 14:30 – RBA cash rate decision

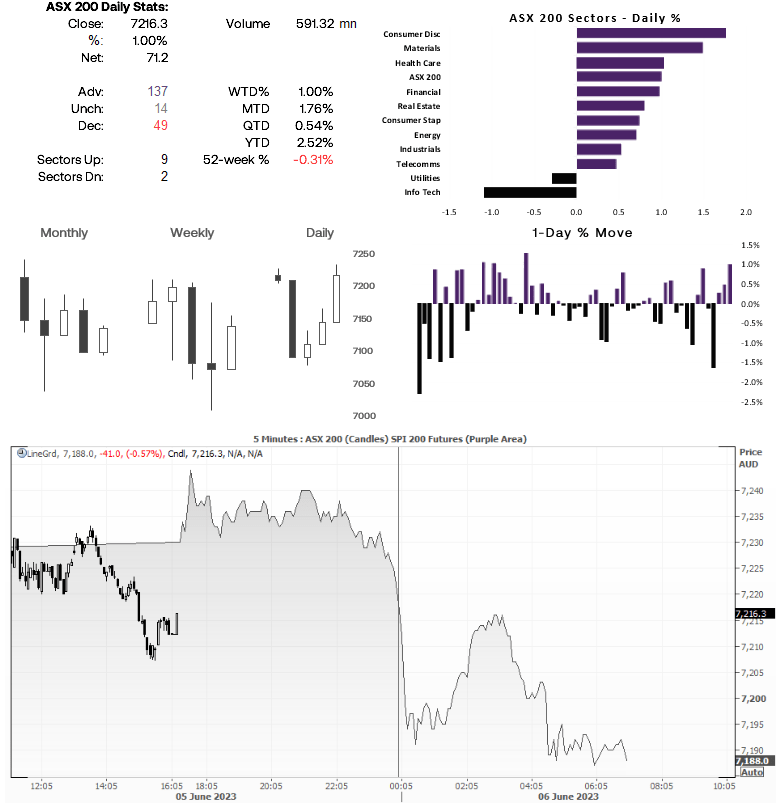

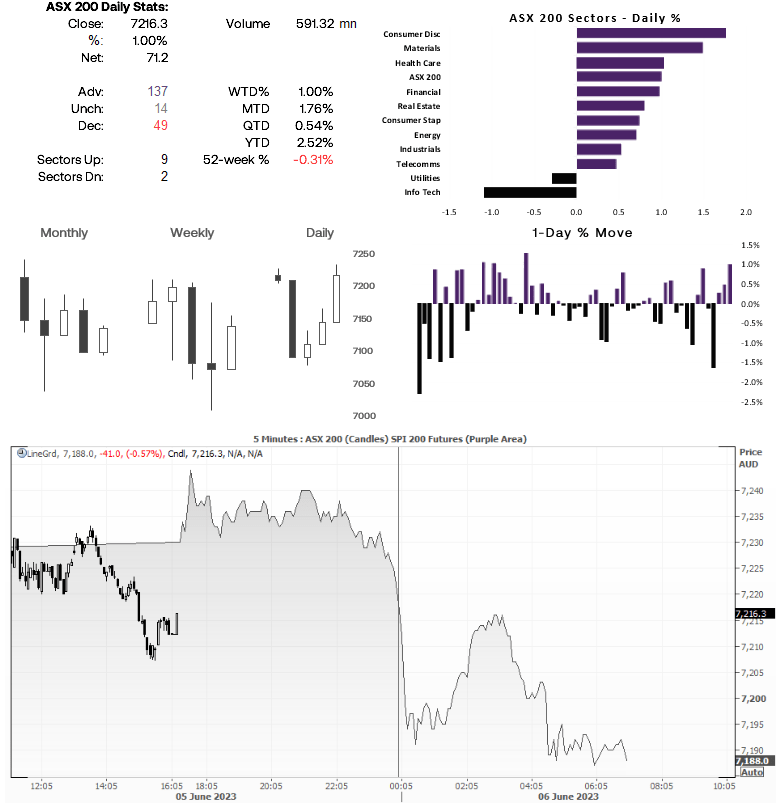

ASX 200 at a glance:

- Yesterday was the most bullish day for the ASX 200 in two months

- It rallied for a third day and closed above 7200

- Its upside could be limited today if the RBA deliver a hawkish pause (and potentially trade lower if they hike)

- SPI futures point to a weak open of ~0.6%

AUD/USD 1-hour chart:

AUD/USD pulled back to the lower support zone outlined in yesterday’s report, and the daily low perfectly respected the VPOC (volume point of control) from the prior rally. The retracement appears to be in three waves, momentum has turned decisively higher and prices have since provided a shallow retracement ahead of today’s RBA meeting. We may find that prices move higher leading up to the meeting in anticipation of a potential hike. Bulls may want to take note of the volume resistance zone around 0.6650, and the upper daily volatility band sits around the daily R1 pivot ~0.6675.

However, if prices pull back then 0.6600 may provide support heading into the meeting. It is then down to whether they hike or deliver a hawkish pause as to how AUD reacts. The probability of a dovish tine seems extremely low given the higher inflation rate and minimum wage increase delivered last week.

Asia Data Calendar (AEDT):

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM