Today's labour force report for January showed a +29.k rise in jobs while the all-important unemployment rate dipped to 6.4% from 6.6% in December - the result of a solid rise in employment and a small drop in the participation rate from a historical high of 6.2% to 6.1%.

The underemployment rate that measures the degree of slack in the labour market (the shortfall between the volume of work desired by workers and the actual volume of work available) fell to 8.1%, its lowest level in almost 2 years.

The upcoming winding back of the Government’s flagship JobKeeper wage subsidy in March will lead to some job losses, particularly in industries such as tourism where demand remains soft. However with the broader labour market in good shape, the economy is expected to make further strides towards the RBA’s goal of full employment.

Broadly todays jobs data is viewed as being supportive of the AUD/USD as are strong commodity prices. Complicating the outlook for the AUD/USD, the sharp rise this week in US bond yields that has provided some support for the US dollar.

Adding to the cross-currents, bumper earnings reports and dividend announcements from the “big 3” Australian mining giants. BHP reported a dividend pay-out that amounts to US$5.1bio, RIO a dividend pay-out of US$6.5bio, and FMG a dividend pay-out that amounts to US$3.2 bio. The bulk of this needs to be repatriated into AUD from USD’s ahead of dividend payment dates in late March/early April.

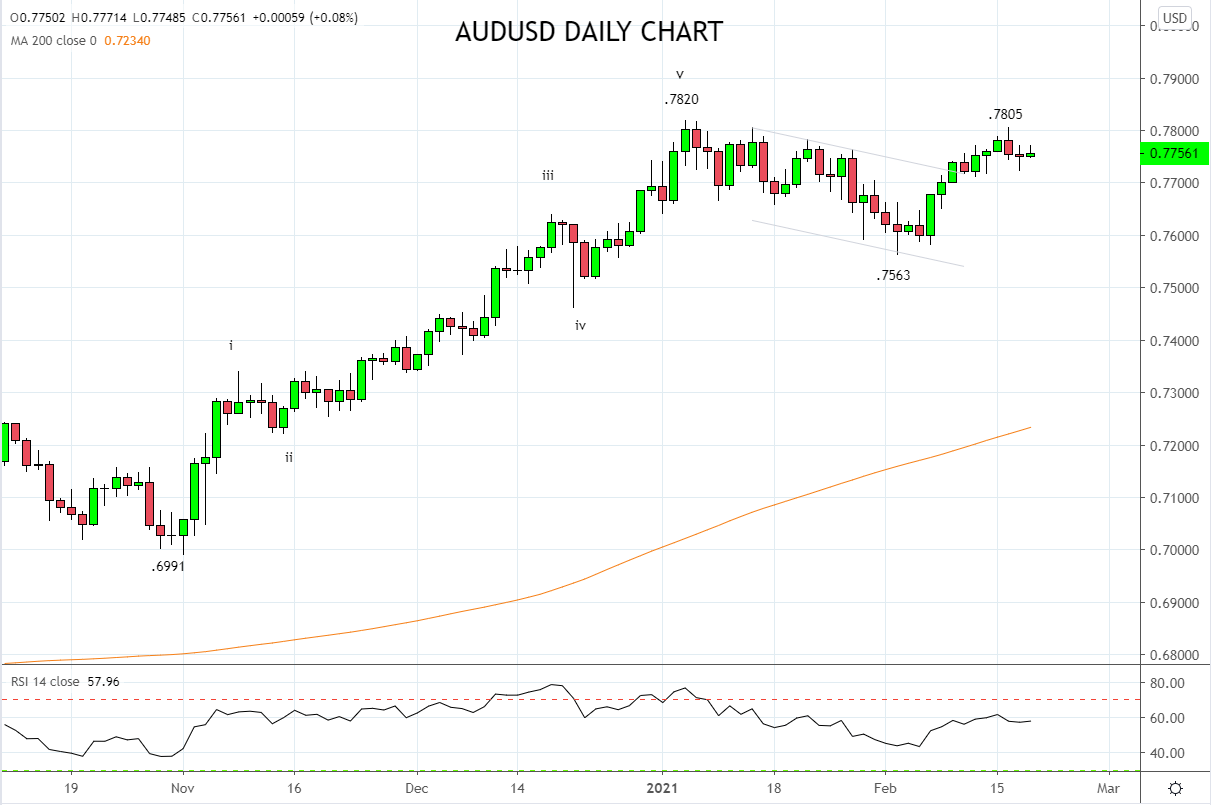

Technically last week’s break above trend channel resistance .7715 area allowed the AUD/USD to push towards the January .7820 high where a loss of momentum candle formed on Tuesday at the .7805 high.

This short-term upside rejection has reinforced the importance of resistance at .7810/20 and the need for a break/close above it to re-ignite the uptrend, towards .8000c. In the interim supported by the factors outlined in this article, buyers are likely to emerge on dips towards .7650.

Source Tradingview. The figures stated areas of the 18th of February 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation