It is noticeable that the early weeks of 2022 have seen a continuation of the volatility that marked the final months of 2021. However, net changes across assets classes exhibit significant divergence.

For example, crude oil is trading 13.5% higher than pre-Christmas. At the same time, the S&P500 cash index closed at 4726 overnight, exactly where it closed the morning of December 24th.

The lack of net movement in the S&P500, testament to strong inflows and underlying strength as equity markets shrugged off the release of the Federal Reserve meeting minutes that showed an earlier and faster rate hiking cycle than expected.

Locally the ASX200 is trading about 0.5% higher than its pre-Christmas close, despite the surge in Omicron cases that will weigh on the reopening and Australian growth in Q1 2022.

Preferring instead to focus on higher commodity prices, supported by the dovish shift by the Chinese central bank in early December and as China again turns to stimulus projects to kick start its stalled economy.

In the first two weeks of 2022, China has announced significant infrastructure projects totaling more than 3 trillion yuan ($471 billion). In contrast, only about 1.2 trillion yuan of major infrastructure projects were announced January 1-19 last year.

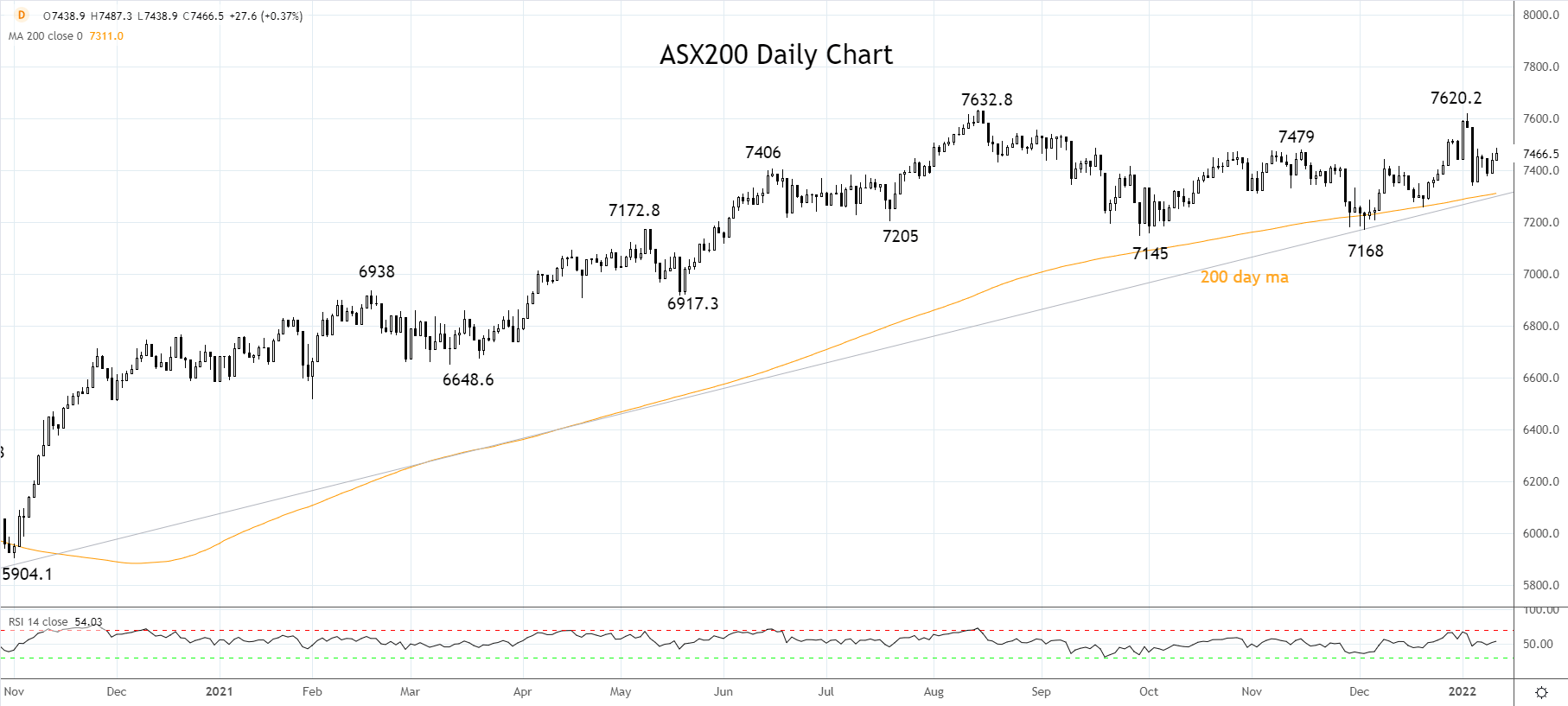

Technically, the ASX200 appears very comfortable trading in a holding pattern near the 7400 level that it spent the last three months of 2021 rotating either side of.

For a sign that this is set to change, watch for a break/close below the support provided by the 200-day moving average and the uptrend drawn from the October 5780 low at 7300. Or above the resistance from the August 7632 high.

Source Tradingview. The figures stated areas of January 13th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade