A sea of green also across regional equity markets led by the Japanese stock market, the Nikkei, which added 2.87% on expectations that an increasingly hawkish Federal Reserve has set its sights on taming rampant inflation.

Overnight St Louis Fed President Bullard reiterated his preference for the FOMC is to move “aggressively” to keep inflation under control and noted the FOMC could not wait for geopolitical risks to be resolved.

Bullard likened the current cycle to 1994 when the Federal Reserve lifted interest from 3.25% to 6% in response to a strong economy and an inflation rate ~2.50% vs 7.9% now.

After a strong reporting season, a staggering $24bn in dividend payments hits investor bank accounts next week. BHP alone is due to pay out $10b in dividends next Monday.

If today’s performance of the IT sector is anything to go by, the divvy dollars look to be finding a home.

Afterpay owner Block (SQ2) traded to its highest level since its ASX200 listing, adding 7.49% to $188.10, Zip Co (Z1P) added 7.52% to $1.65, Sezzle (SZL) lifted by 5.69% to $1.49, Appen added 3.51% to $7.07, and Xero (XRO) added 4.16% to $102.93.

Another ratchet higher in yields overnight provided support for the Financial Sector as it allows the big banks to increase profitability via higher Net Interest Margins.

Macquarie (MCQ) added 1.25% to $200.05, its highest close in six weeks as it bids for ASX listed firm Uniti. National Australia Bank (NAB) added 1.57% to $31.72, ANZ added 0.76% to $27.88, Westpac (WBC) added 0.76% to $23.80, and Commonwealth Bank (CBA) lifted by 1.30% to $107.45, closing in on its all-time high at $110.19.

Crude oil is trading back above $110/bbl despite it becoming increasingly unlikely the EU will join the U.S in a Russian oil embargo. Woodside Petroleum (WPL) added 0.44% to 32.30. Santos (STO) closed 0.26% lower at $7.77, while Beach Energy (BPT) lost 1.54% to $1.60.

A 1.2% fall in the iron ore price to $148.50 has weighed on the Materials sector. Mineral Resources (MIN) fell 1.55% to $48.33. BHP Group (BHP) lost 0.78% to $48.44. Rio Tinto (Rio) closed flattish at $113.68. Fortescue Metal Group (FMG) bucked the trend to trade 0.32% higher to $19.00.

A slump in the price of gold to $1922 (-0.75%) on improved risk sentiment and higher yields have weighed today on ASX200 listed goldies. Newcrest Mining (NCM) fell 2.04% to $25.45. Northern Star Resources (NST) lost 1.98% to $10.39, Evolution Mining (EVN) lost -1.57% to $4.38.

Onwards and upwards for the Australian dollar, trading at four-month highs at .7455, despite the broader commodity complex easing and higher U.S. yields.

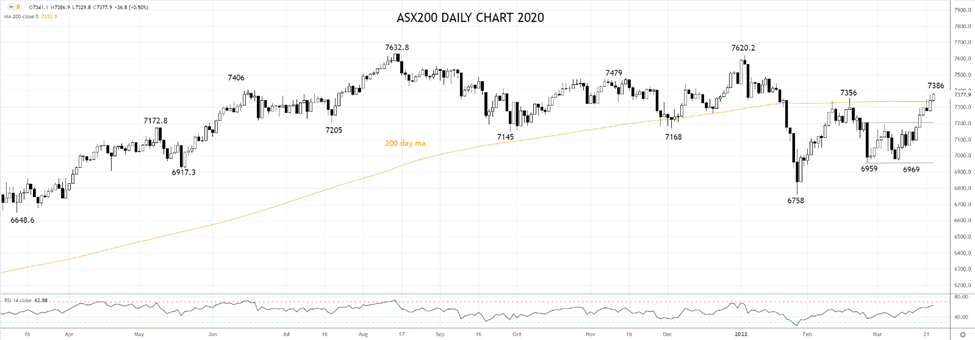

Source Tradingview. The figures stated are as of March 23rd, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade