The rally despite the ASX24 futures trading platform suffering a four-hour outage due to a "hardware-related" issue. A breakdown that prevented traders from Portfolio Managers at billion-dollar hedge funds to private traders accessing liquidity over today's Australian jobs data for February.

The ASX will undoubtedly receive a please explain from joint regulators ASIC and the RBA. The systems failure may force institutional traders to assess whether the ASX200's suite of futures products can remain part of their trading strategy, particularly if they cannot manage their risk over tier-one domestic data releases.

Turning to markets, the Federal Reserve followed the lead of the ECB last week this morning to deliver a hawkish surprise.

The Feds median dot in 2023 at 2.75% indicates an intention to take the terminal rate firmly above the neutral rate. An imminent start to quantitative tightening was also flagged. Despite this, equity markets ripped higher, contrary to what might have been expected, led by the tech-heavy Nasdaq.

A move that has flowed through into the local IT Sector, which followed up its 3.24% gain yesterday, adding another 3.83% today. Once again, the star of the show, Block (SQ2) added 10.71% to $158.32. Z1P Co (ZIP) added 9.44% to $1.57, Wisetech Global (WTC) added 3.44%, and Xero (XRO) chimed in with a 2.75% gain to $99.83.

Resource stocks have benefiting from China's State Council announcement yesterday, steps to restore confidence in the economy and capital markets. A new Covid treatment strategy was also revealed to balance Covid containment with economic activity. Fortescue Mining (FMG) is the best of the big three mining heavyweights, adding 3.76% to $18.05. BHP Group (BHP) has lifted by 0.95% to $45.61 and Rio Tinto (Rio) added 01.17% to $108.16. Also helped by a 4% rally in iron ore futures in Asia.

The ASX200 Financial Sector added another 1% to test levels not seen since the first week of 2022. ANZ again the best of the big four banks, adding 1.58% to $27.60. Commonwealth Bank (CBA) added 1.26% to $106.07, eyeing its all-time high at $110.19. National Australia Bank (NAB) added 1.41% to $31.19, while Macquarie Group (MQG) added 1.69% to $192.67.

Still relishing in the joy of the crude oil price trading 30% below last week's high and news that New Zealand will begin opening its borders next month, travel stocks have had another good day Qantas (QAN) shares lifted 1.78% to $5.14, Webjet (WEB) added 1.59% to $5.76, and Flight Centre (FLT) added 1.73% to $19.43.

Despite a rise in the gold price in Asia to $1936 (+0.50%), it’s been a disappointing day for Aussie goldies. Northern Star Resources (NST) fell by -0.56% to $10.48, while Evolution Mining (EVN) fell by 0.67% to $10.48. Newcrest Mining (NCM) traded flat on the day at $25.93.

On the data front Australians labour force data for February was very strong. Employment rose by 77k vs expectations of 40k. The unemployment rate dropped to 4%, its lowest level since 2008 despite the participation rate rising to 66.4%, it highest level on record.

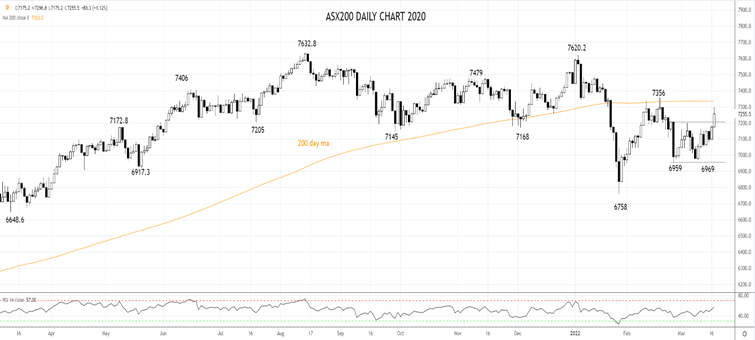

Source Tradingview. The figures stated are as of March 17th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade