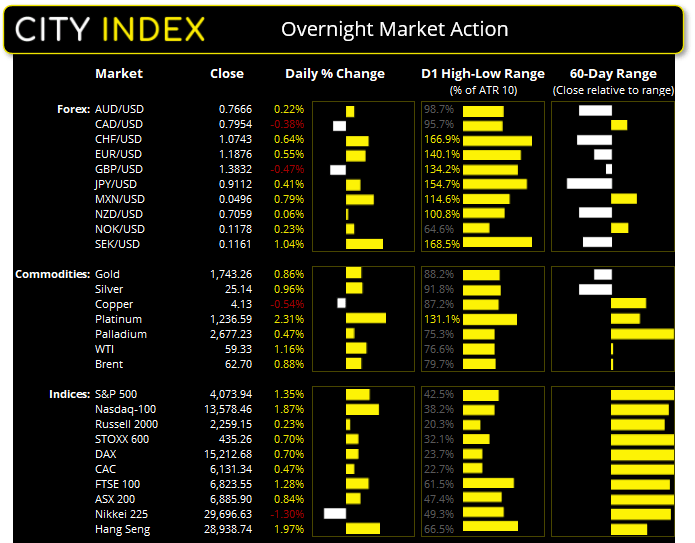

Asian Futures:

- Australia's ASX 200 futures are up 25 points (0.36%), the cash market is currently estimated to open at 6,910.90

- Japan's Nikkei 225 futures are down -70 points (-0.24%), the cash market is currently estimated to open at 29,626.63

- Hong Kong's Hang Seng futures are up 114 points (0.4%), the cash market is currently estimated to open at 29,052.74

UK and Europe:

- The UK's FTSE 100 futures are up 89 points (1.33%)

- Euro STOXX 50 futures are up 21 points (0.54%)

- Germany's DAX futures are up 100 points (0.66%)

Tuesday US Close:

- The Dow Jones Industrial fell -96.95 points (-0.29%) to close at 33,430.24

- The S&P 500 index fell -3.97 points (-0.1%) to close at 4,073.94

- The Nasdaq 100 index fell -19.705 points (-0.14%) to close at 13,578.46

US indices uninspired with higher JOTLS and global growth upgrade

US jobs openings hit a two-year high in February, rising to 7.4 million compared with 6.9 million in January. The combination of stronger demand thanks to covid vaccinations and government stimulus increased the need for more workers, making this employment print the latest in a growing line of strong data sets for the US this month so far.

On vaccinations, Biden increased his target for all American adults to be eligible for the jab by 19th April and says over 80% of teachers and school staff had received at least one shot already. And (whilst we’re on a roll) the IMF have forecast global growth to hit 6% this year, a level not seen since the 1970s, all thanks to unprecedented public spending!

Yet despite all of the positivity in the air, Wall Street failed to push materially higher. The S&P 500 made a minor intraday record high yet closed with a very small indecision candle just off its highs, which will no doubt make some bulls nervous. But, of course, it takes more than one small candle to ruin a trend. The Dow Jones printed a small, bearish inside day just off its own record high and the Nasdaq 100 closed with a small bearish pinbar.

The ASX 200 closed to a seven-week high yesterday after RBA kept their policy unchanged. Bulls finally broke the index above 6850 resistance, a level which had capped all minor rallies throughout March. Although whilst this looks promising, we’d like to see a high-volume break above 6938 (YTD high) before celebrating. Until then, the risk remains for mean reversion traders to push prices lower back inside its range.

Learn how to trade indices

Forex: Sterling ‘pounded’, dollar declines

The British pound was the weakest major overnight, seemingly on reports that an EMA official sees a clear link between rare blood clots on the brain of patients who used the Oxford-AstraZeneca vaccine (which is on the UK’s approved list). With fears this could stymie the UK’s recovery, investors were quick to sell the British pound against (pretty much) everything. Curiously there is little being said on the pounds moves overnight so, if it is not related to vaccine concerns, we’re yet to find out why.

- EUR/GBP was the strongest pair, GBP/JPY was the weakest and the pound was broadly lower against all majors.

- GBP/CHF fell over -1.1% and formed a bearish closing Marabuzo (an elongated bearish candle which closes at its low) after slicing through 1.3000.

- GBP/USD produced a bearish engulfing / outside candle on the daily chart.

- The bullish bias on GBP/NZD from yesterday’s European open report has been quickly invalidated as it fell to a two-week low and GBP/AUD fell -0.7% amid a strong counter-trend move.

The US dollar index (DXY) extended its decline and broke beneath 92.50 support outlined in yesterday’s Asian Open report. If the dollar has indeed topped then this should bode well for major currencies, and particularly EUR/USD has now rallied over 1.2% in the past two sessions and invalidated its bearish trendline on the daily chart.

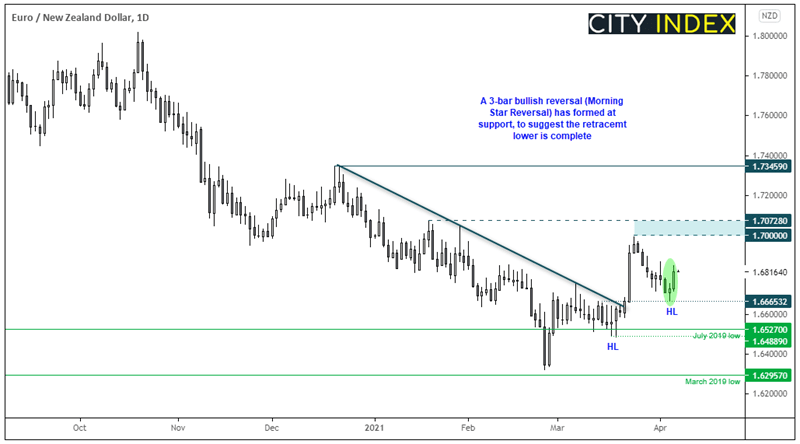

EUR/NZD to retest 1.7000?

The weaker US dollar has provided the euro with breathing space to lift itself off its lows. Whilst this is the case to all majors, the euro is regaining traction against the New Zealand dollar which we continue to think is carving out a longer-term reversal.

In March we identified its potential to break above its bearish trendline. Having since done just that, prices have retraced and formed another higher low at 1.6665 support. Given the three-bar bullish reversal pattern (morning star reversal) we suspect the swing low is now in place and bulls could try and take it towards the 1.6948 – 1.7000 resistance zone.

- The bias remains bullish above 1.6665 support and for a run towards the 1.7000/72 resistance zone.

- A break above the resistance zone clears the way for a run towards 1.7345/1.7000.

- Bulls could wait for a break above yesterday’s high or seek bullish setups inside yesterday’s range, if confident the low is really in.

Learn how to trade Forex

Commodities: Metals perk up

Major metals were mostly higher overnight thanks to a weaker US dollar. Gold closed to a two-week high, back above its 10 and 20-day eMA, and trades around 1743. Silver printed a small bullish engulfing candle which closed above its 10-day eMA yet found resistance below the 20-day eMA.

Oil prices continues to trip over themselves with WTI and brent futures sticking to their recent style of choppy, sideways trade on the daily chart. WTI closed on its 50-day eMA and 59.20 and brent also closed near the same technical level at 62.69.

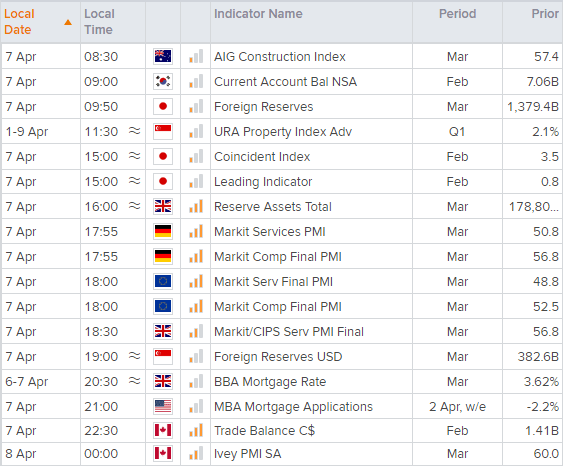

Up Next (Times in AEST)

You can view all the scheduled events for today using our economic calendar, and keep up to date with the latest market news and analysis here.