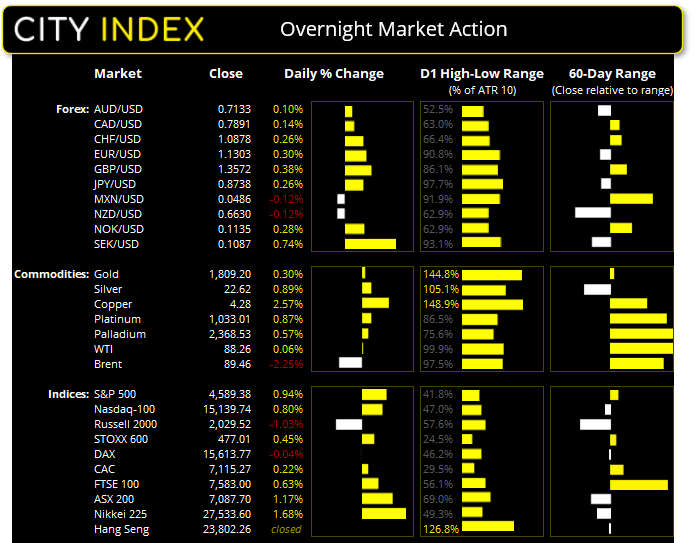

Wednesday US cash market close:

- The Dow Jones Industrial rose 224.09 points (0.63%) to close at 35,629.33

- The S&P 500 index rose 42.84 points (0.95%) to close at 4,589.38

- The Nasdaq 100 index rose 120.062 points (0.8%) to close at 15,139.74

Asian futures:

- Australia's ASX 200 futures are up 7 points (0.1%), the cash market is currently estimated to open at 7,094.70

- Japan's Nikkei 225 futures are down -100 points (-0.36%), the cash market is currently estimated to open at 27,433.60

- Hong Kong's Hang Seng futures are down 0 points (0%), the cash market is currently estimated to open at 23,802.26

- China's A50 Index futures are down -90 points (-0.6%), the cash market is currently estimated to open at 14,679.78

Wall Street continued to climb into the close with the S&P 500 hitting a 9-day high and a 0.9% gain on the day. The Nasdaq was a close second with a 0.8% gain, although its inverted hammer on the daily chart it about to become a lot more significant as Meta Platforms (FB) plunged -18% after hours trade. It’s fair to say that Meta has just been Zucker punched with Q1 revenue expected to be $27 - $29 billion, compared with $30.25 billion expected. And it comes at a time that US indices have continued to climb despite volumes falling, which means recent gains could be of the ‘bear-market’ bounce variety, and not that of a heathy rebound.

With Nasdaq futures already taking out yesterday’s open price and back below 15,000 then it look increasingly likely we’ve just seen a swing high. Tech shares on the ASX 200 are likely to come under pressure today and it’s plausible that yesterday’s tap of 7100 marked its high, as the index has also risen with underwhelming volumes the past three days. And the same can be said for the Nikkei 225 as its rally stalled around the December lows yesterday.

A complete guide to Facebook

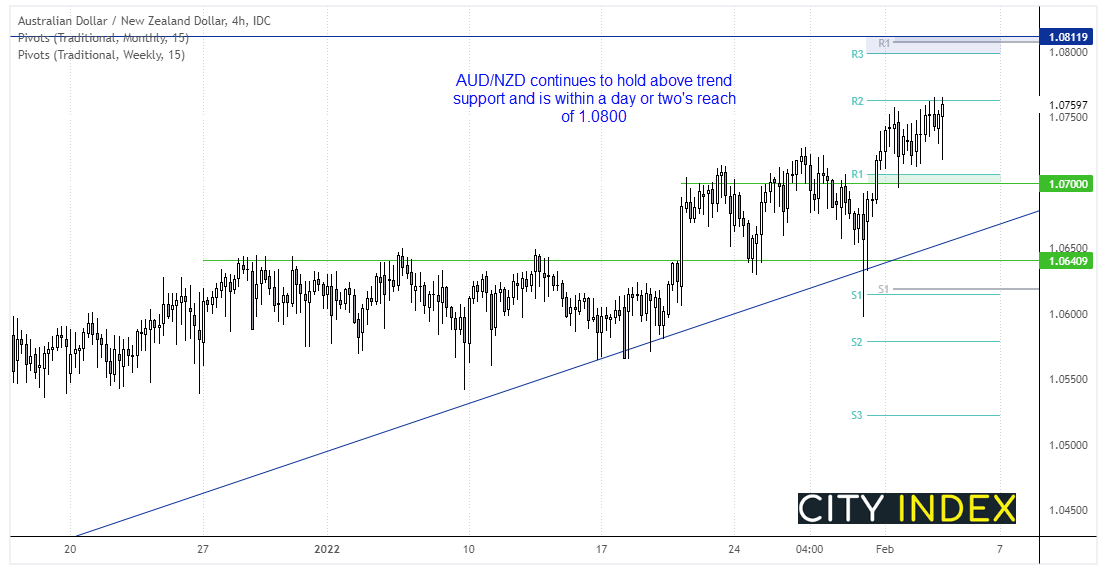

AUD/NZD eyes 1.0800 during a busy data day

PMI, housing credit and trade data are lined up for Aussie traders today and, if the data allows, it could help AUD/NZD hit our target near the 1.0800 highs. The cross remains above trend support and a series of lower wicks have confirmed support around 1.0700, so as long as prices hod above those lows our target for 1.0800 remains in place, near the weekly R3 and monthly R1 pivot.

Elsewhere for currencies, GBP and EUR were the strongest major whilst NZD and USD were the weakest. EUR/USD has recouped all of its post-FOMC losses after eurozone inflation hit a record high. HCIP CPI rose to 5.1%, up from 5.0% prior and far outpacing the 4.4% forecast. EUR/USD rose to a 6-day high and closed above 1.13 and is now testing trend resistance. USD/JPY fell for a fourth consecutive day, above 50 eMA, RSI (2) nearly oversold.

WTI rallied to just shy of $90

Oil prices initially rose to a fresh 7-year high yesterday and hit our upside target at the weekly R1 pivot, stopping just shy of the $90 milestone. OPEC+ increased production at 400k bps as expected, although crude stockpiles were lower and oil remains supported by supply concerns. Still, $90 is a big level and likely to hold for now, and price action on the daily chart shows a series of upper wicks to suggest a hesitancy to break immediately higher.

Trend day on ASX 200 probes 7100

We saw a decent close on the ASX 200 yesterday which probed 7100 before closing just beneath it. A slight caveat is that (like US markets) we continue to see prices rise on lower volumes, which keeps the potential of a bear-market bounce alive and well. But such bounces can have legs, so to speak, and that still leaves the potential for near-term gains if prices are accepted around current levels. Yesterday’s value area (70% of market action took place) sits between 7068 – 7103) so ideally price action today will remain above 7068 before continuing higher. 7089 as the most actively traded price and can act as a magnet, and a break above 7110 would be constructive for the near-term bull-case to target 7140.

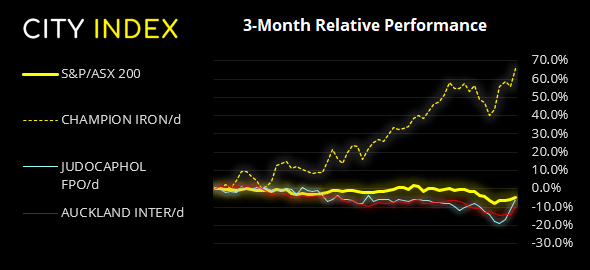

ASX 200: 7087.7 (1.17%), 02 February 2022

- Energy (2.84%) was the strongest sector and Utilities (-0.43%) was the weakest

- 9 out of the 11 sectors closed higher

- 2 out of the 11 sectors closed lower

- 2 out of the 11 sectors outperformed the index

- 27 (13.50%) stocks advanced, 166 (83.00%) stocks declined

Outperformers:

- +6.15% - Champion Iron Ltd (CIA.AX)

- +5.91% - Judo Capital Holdings Ltd (JDO.AX)

- +5.37% - Auckland International Airport Ltd (AIA.AX)

Underperformers:

- -6.34% - Credit Corp Group Ltd (CCP.AX)

- -3.54% - Amcor PLC (AMC.AX)

- -2.72% - Zip Co Ltd (Z1P.AX)

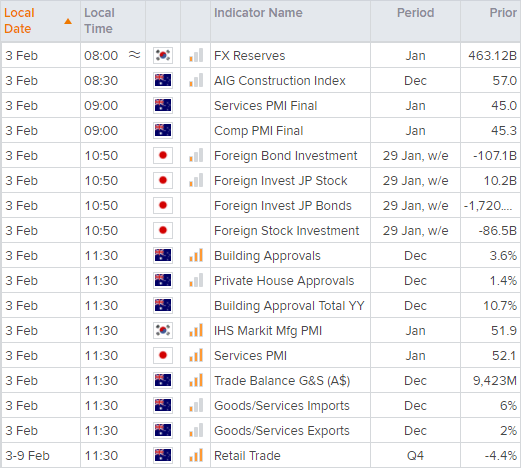

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade