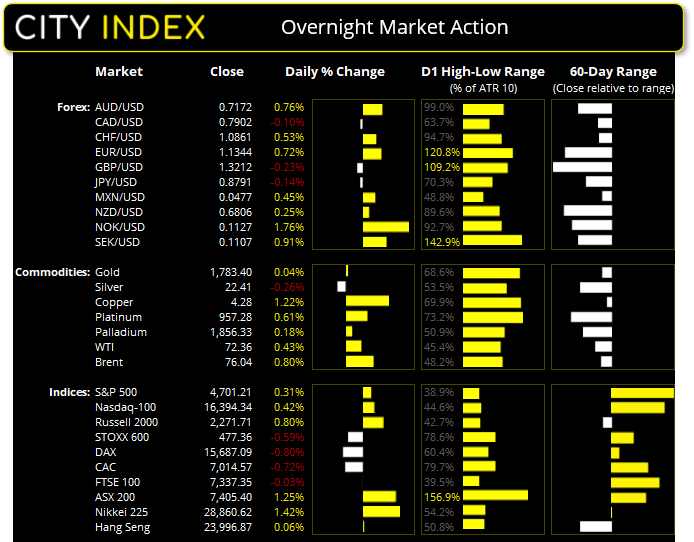

Wall Street extended its rally for a third day, although momentum is showing signs of waning with daily ranges for the major indices all below their ATR’s (average true ranges). But perhaps this is to be expected from a tactically viewpoint as they edge towards their record highs. And as it’s generally not until the middle of the month until Santa’s rally really kicks in and US CPI is tomorrow, it leaves potential for another week of potential chop before the rally (hopefully) kicks in.

BOC not as hawkish as some had hoped

That’s not to say BOC were dovish either but could be seen as such relative to some expectations of a hike in Q1. A hike in Q1 was dispelled by still vowing to keep rates low until “economic slack is absorbed” so that 2% CPI is achieved by “sometime in the middle quarters of 2022”. This means April is the earliest meeting they could hike. And perhaps not yet significant but worth noting is the removal of how “vaccines are proving highly effective against the virus” from their statement in the face of the Omicron breakout. So, whilst they’re not yet ringing alarm bells it could be a cause for a later hike should Canada follow the UK’s steps with some sort of ‘Plan B’.

Guide to CADCAD pairs gave back some of Tuesday’s gains which allowed NZC/CAD to print a bullish engulfing candle around support and GBP/CAD recover back above the November low. AUD/CAD rallied higher and removed any hopes of a breakout from its (now defunct) bearish flag. CAD/JPY and USD/CAD were effectively flat by the close.

Plan ‘B’ weighs on the pound

The UK government has confirmed that ‘Plan B’ will be triggered due to the rise of Omicron cases in the UK. Face masks are now compulsory in most indoor venues (excluding hospitality) and those who can are encouraged to work from home. It has been warned that London is the epicentre of the Omicron outbreak and that cases could begin to double in 2-3 days. Some are also suggesting a lockdown by January if hospitalisations rapidly rise over Christmas. GBP was weak across the board and lost around -1% against AUD, EUR and 0.8% against CHF.China Inflation data at 12:30 AEDT

Today’s inflation data is in some ways a warm-up for US CPI tomorrow. Although a key difference is that consumer prices in China are significantly lagging relative to producer prices (unlike the US). Perhaps this will change and the gap could narrow as, historically, the CPI-PPI spread does not remain high for long.

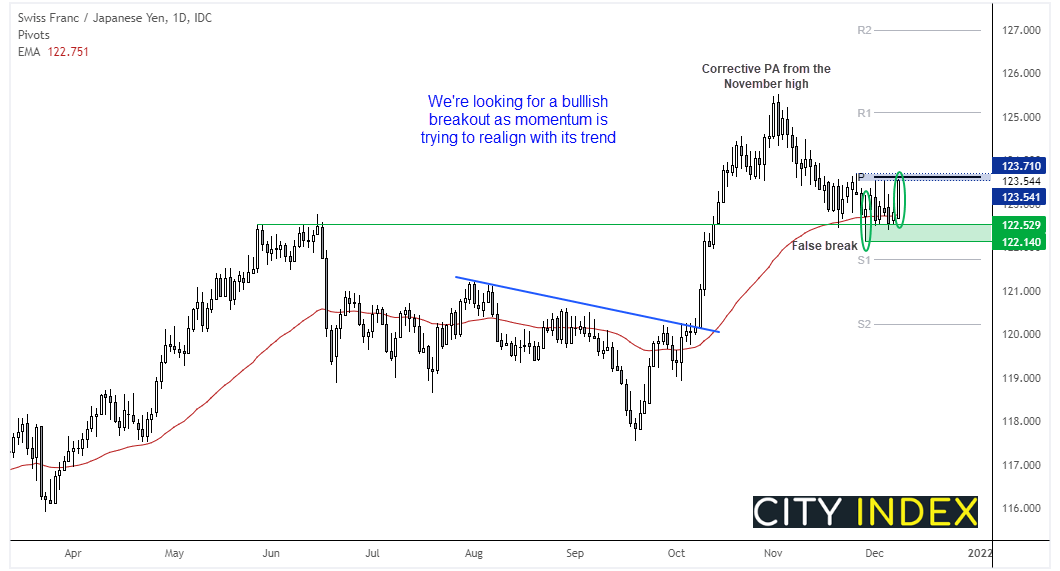

CPI and forexCHF/JPY considers breakout

CHF/JPY is one of those pairs that is easily ignored but can provide some solid moves, with the risk of ‘blink and you miss it’ thrown in. We’ve been keeping an eye on its pullback from the November high as it tried to carve out a base around the May and June highs, and we think it’s ready to pop higher.

A spike lower on 29th November may have marked the corrective low and yesterday’s bullish range-expansion candle took prices to a 9-day high, so with momentum seemingly realigned with its bullish trend we think the market is now ready to head towards 125 and revisit the November high. A break above the 123.71 high / monthly pivot point assumes bullish continuation.

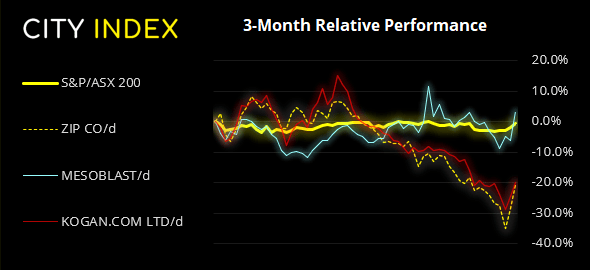

ASX 200 Market Internals:

ASX 200: 7429.3 (1.58%), 08 December 2021

- Materials (2.14%) was the strongest sector and Utilities (0.15%) was the weakest

- 11 out of the 11 sectors closed higher

- 4 out of the 11 sectors outperformed the index

- 156 (78.00%) stocks advanced, 33 (16.50%) stocks declined

- 60.5% of stocks closed above their 200-day average

- 50.5% of stocks closed above their 50-day average

- 55% of stocks closed above their 20-day average

Outperformers:

- + 10.9%-Zip Co Ltd(Z1P.AX)

- + 10.0%-Mesoblast Ltd(MSB.AX)

- + 6.17%-Kogan.com Ltd(KGN.AX)

Underperformers:

- -4.01% - Steadfast Group Ltd (SDF.AX)

- -2.71% - Polynovo Ltd (PNV.AX)

- -2.31% - Orora Ltd (ORA.AX)

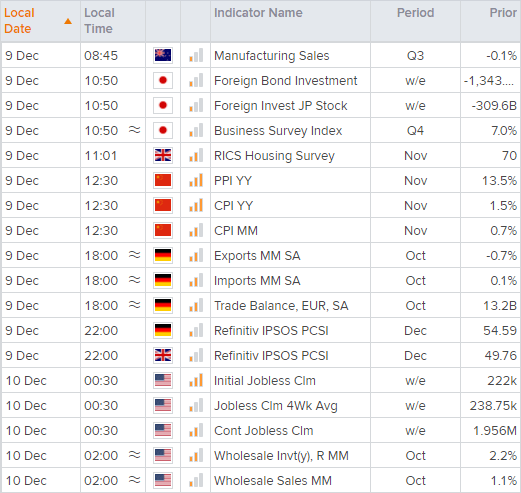

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade