Popular instruments

Metals explained

What are the trading hours for metals?

You can trade most metals – including gold, silver and platinum – 23 hours a day from Monday morning to Friday , with a break from 08:00 to 09:00 AEST. However, there will be times when precious metal markets are more volatile and liquid than others.

The precise times for each market will vary depending on whether you’re trading its spot, futures or options variant. You can see a full rundown of the hours for each market on our commodity hours page.

Can you day trade precious metals?

Yes, you can day trade precious metals including gold, silver, platinum and more. To day trade these precious metals, you need to ensure that you all your positions are closed by 5pm EST, which is 9am AEST. This avoids the risk of overnight gapping and funding charges impacting your bottom line.

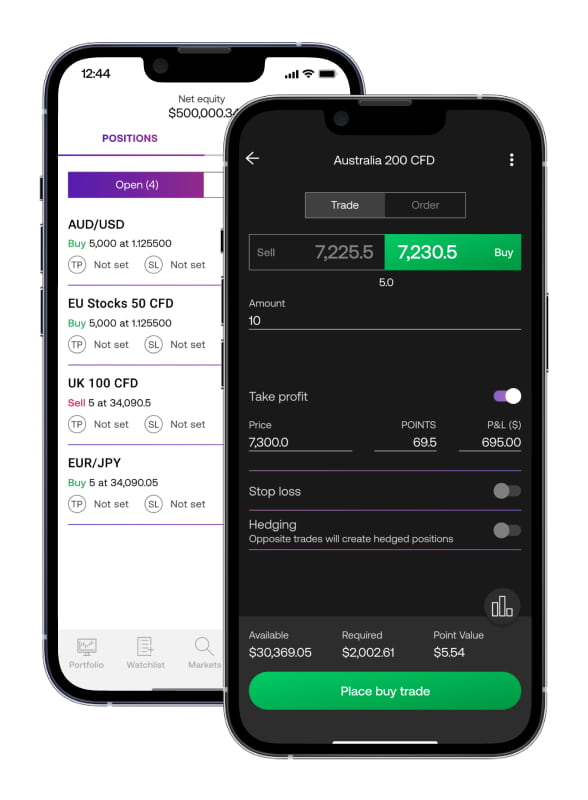

CFD trading is a popular way to day trade precious metals. It enables you to speculate on metal prices without ever taking ownership of the markets themselves, and provides access to leverage to make your capital go further – although leverage will also increase your risk.

Learn more about CFD trading on precious metals.

How do you trade metals?

There are a few different ways to trade metals. Most metals trading in the open market is executed via futures – derivatives that involve trading a metal on a set date in the future at a price set today.

To buy and sell metals futures, you’ll need an account with a futures broker. Or, you can trade on futures prices using CFDs – which enable you to go long or short on metals without ever taking ownership of the underlying asset.

Learn more about how to trade commodities.